Welcome to Richard Lawson.

Before we dive into one of the most consequential energy policy failures in modern American history, I want to ask you to hit that subscribe button and turn on notifications.

This is the kind of investigative reporting that mainstream media often ignores.

Leave your thoughts in the comments below and share this video with anyone who needs to understand what’s really happening with gas prices across the Southwest.

This story begins on September 10th, 2024.

Two governors, one Democrat and one Republican, came together to send an urgent letter to California.

Arizona Governor Katie Hobbs and Nevada Governor Joe Lombardo put aside partisan differences to warn about what was coming.

They weren’t being dramatic.

They were trying to prevent a crisis.

The subject was California’s new refinery regulations.

These weren’t minor policy adjustments.

These were sweeping changes that would fundamentally alter how refineries operate in the state.

Arizona and Nevada had a simple message.

These regulations will create fuel shortages and drive up prices in our states.

The reason was straightforward.

Arizona gets 60% of its gasoline from California refineries.

Nevada depends on California for 70% of its fuel supply.

When California’s refinery system breaks down, these neighboring states pay the price.

Their entire fuel infrastructure runs through California pipelines.

There is no backup plan.

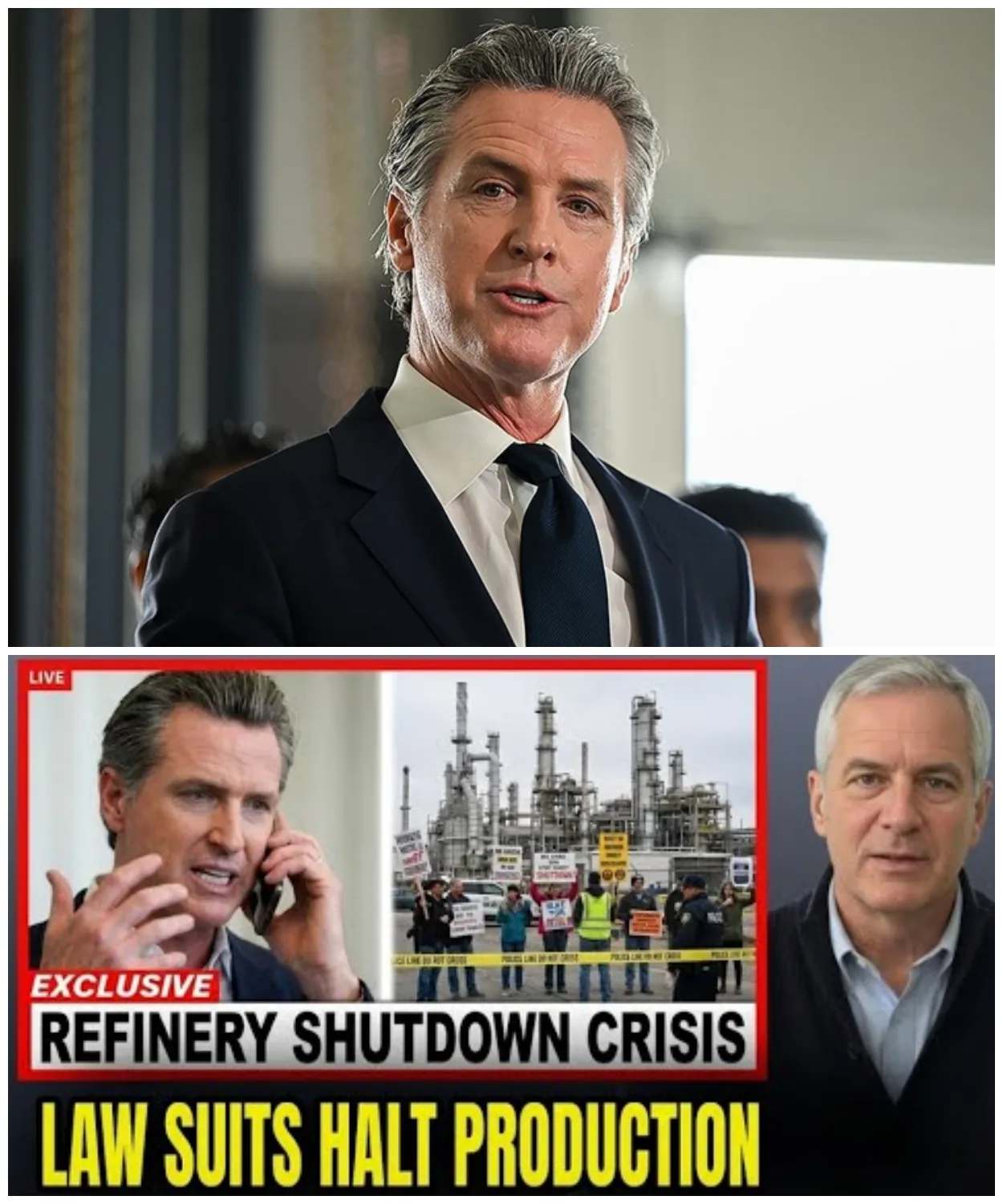

Governor Gavin Nuome didn’t take long to respond.

On the same day, September 10th, he took to Twitter to fire back at the two governors.

His message was clear.

He believed refineries were manipulating the market.

According to Newsome, the real problem was refineries choosing not to replace their supply while offline for maintenance.

He claimed this deliberate decision was what caused price spikes.

His proposed regulations, he insisted, would save consumers hundreds of millions of dollars every year by preventing these price manipulation tactics.

As reporters continued pressing him on the concerns raised by Arizona and Nevada, his tone grew sharper.

He expressed frustration at what he saw as oil companies taking advantage of taxpayers.

He suggested they had been deceiving the public for decades.

Just six days later, on September 16th, Newsome sent a formal written response to both governors.

The letter accused them of simply repeating talking points from big oil companies.

This was a remarkable accusation.

Katie Hobbes, a Democratic governor trying to protect her citizens from higher gas prices, was being labeled as a puppet of the oil industry.

Joe Lombardo received the same treatment.

Nuome made it clear he viewed their concerns as illegitimate, driven not by genuine worry about their constituents, but by corporate interests.

On October 14th, 2024, Governor Nuome signed the regulations into law.

He did this despite the warnings from Arizona and Nevada.

He did this despite his own California Energy Commission expressing concerns.

The signing ceremony was positioned as a victory over big oil.

Newsome framed it as standing up to corporate greed and protecting consumers from price gouging.

The regulations contained two major provisions.

First, refineries would be required to maintain minimum fuel inventory levels.

Second, California would gain authority to regulate refinery profit margins.

The state could now determine what it considered acceptable profit levels for refining operations.

Three days later, on October 17th, Philip 66 made an announcement that sent shock waves through the energy sector.

The company declared it would shut down its Los Angeles area refinery.

This facility produced 139,000 barrels per day.

That production capacity would simply disappear.

Philip 66 stated that market conditions made continued operations economically unfeasible.

In simpler terms, California’s new regulatory environment had made it impossible to run a refinery profitably.

The writing was on the wall.

When you tell companies they must maintain expensive inventory, limit their profit margins, and operate in an increasingly hostile regulatory climate, they make business decisions accordingly.

Then in April 2025, Valero Energy followed suit.

The company announced it would close its Benicia refinery by April 2026.

This facility produced 145,000 barrels per day.

Valero’s chief executive was candid about the reasons California had been pursuing fossil fuel reduction policies for 20 years.

The regulatory environment had become the most stringent and challenging in North America.

The company could no longer justify operating under these conditions.

These two closures combined represented 20% of California’s total refining capacity.

1if of the state’s gasoline production was set to vanish within 18 months.

Let that sink in.

California was about to lose 20% of its ability to produce gasoline for its residents.

For Arizona and Nevada, this was exactly the nightmare scenario they had warned about.

Their fuel supply was directly tied to these refineries.

When Newsome was asked about the Philips 66 closure, his office remained silent for weeks.

When they finally responded, they accused the refinery of trying to dodge regulations and abandoning California residents.

What they did not address was whether the regulations themselves played any role in the decision to close.

State Senator Brian Jones stepped forward on May 6th, 2025 with another warning letter.

Senator Jones painted a stark picture of what was coming.

He warned that gas prices could reach $843 per gallon.

This wasn’t hyperbole.

The USC Marshall School of Business released analysis predicting prices could jump as much as 75%.

Jones offered to work with the governor’s office to find solutions.

He received no response.

There was no acknowledgement of his letter.

No meeting was scheduled.

The warning was simply ignored.

By June 2025, even the California Energy Commission began sounding alarms.

This is significant because the commission is part of Newsome’s own administration.

These were not political opponents or industry advocates.

These were state officials tasked with managing California’s energy supply.

The commission stated plainly that California needed to stabilize refining operations.

The situation was deteriorating.

Refineries were leaving the state.

Something had to change.

This was when Nuome finally acknowledged the existence of a problem.

He called for a collective effort to address what he termed market disruptions.

But when reporters asked whether he would reconsider the regulations that triggered the refiner closures, he deflected.

He held press conferences promising to handle the crisis without accepting any responsibility for creating it.

The message was clear.

The problem was everyone else’s fault.

In July 2025, the urgency reached a new level.

California officials began holding secret negotiations to find a buyer for Valero’s Benicia refinery.

Think about the irony here.

The state that had created regulatory conditions forcing Valero to leave was now desperately trying to convince them to stay.

Reports emerged suggesting California might offer hundreds of millions of dollars in subsidies to keep the refinery operational.

This would be taxpayer money used to rescue a business that state regulations had made unprofitable.

The very regulations Newsome championed as protecting consumers were now requiring massive bailouts to prevent their most obvious consequences.

Environmental groups that had supported the original regulations were furious.

10 organizations signed a joint statement condemning the potential bailout.

They called it a plan that sacrifices communities for industrial profit.

The irony was palpable.

Environmentalists who had cheered the tough stance against refineries now watch the state prepare to pay those same refineries to stick around.

By August 2025, California officials made another significant reversal.

The California Energy Commission announced that profit cap penalties would be delayed until 2030.

The regulation that was supposed to prevent price gouging had been quietly postponed for 5 years.

Vice Chair Siva Gunda assured the public this would allow for a smooth transition.

But the question remained, what happened to the fight against big oil greed? What happened to protecting consumers from price gouging? The regulation that Newsome had signed with such fanfare was now being shelved because its immediate implementation would cause exactly what Arizona and Nevada had predicted.

It’s worth revisiting that original letter from September 2024.

Arizona and Nevada had cited California’s own energy commission reports.

Those reports stated clearly that these regulations could create fuel shortages.

Nuome’s own experts had identified the risk.

He chose to proceed anyway.

Now, California found itself scrambling to undo the damage.

The infrastructure reality made the situation worse.

Arizona and Nevada cannot simply buy gasoline from other sources.

The pipeline system doesn’t work that way.

All major pipelines run from California refineries to these neighboring states.

There is no alternative supply route.

You cannot just redirect fuel from Texas or other producing states.

The physical infrastructure does not exist.

In February 2025, a fire at the Martinez refinery illustrated the fragility of the system.

The Martinez refinery fire took 10% of California’s gasoline production capacity offline.

The impact was immediate and severe.

Gas prices in Arizona jumped 50 cents overnight.

Nevada saw increases of 40 cents per gallon.

This was precisely what the governors had warned about in their September 2024 letter.

Any disruption to California’s refinery system would hit their states hard.

Nuome blamed the refinery for inadequate maintenance.

He did not acknowledge that the new regulations left no room for error.

Refineries operate on thin margins.

Unexpected shutdowns happen.

The system needs flexibility to handle disruptions.

The new requirements eliminated that flexibility.

Consider what the regulations demanded.

Refineries had to build massive new storage tanks to maintain minimum inventory levels.

Chevron stated publicly that each tank would cost $35 million and take 10 years to construct.

If you’re operating a refinery with already tight profit margins, that’s an impossible investment, especially when the state has announced plans to ban gas-powered vehicles by 2035.

What company invests tens of millions in infrastructure for a product the state plans to eliminate? Throughout this process, Newsome maintained that refineries were earning excessive profits.

His own California Energy Commission found no evidence of price gouging.

The Federal Trade Commission investigated and found nothing.

Independent economists examined the data and reached the same conclusion.

There was no price gouging occurring.

Despite the complete absence of evidence, Newsome needed someone to blame.

Refineries became the scapegoat.

By late 2024, California had issued an $82 million fine to Valero for air quality violations.

This was the largest environmental fine ever levied against a refinery in state history.

The timing was remarkable.

California fined Valero in December 2024, then spent the next several months trying to convince them not to leave.

Now, the state was considering offering hundreds of millions in subsidies to a company they had just penalized.

Environmental groups watched in disbelief as the state begged refineries to stay after spending years trying to force them out.

Meanwhile, gas prices continued climbing.

California’s average price reached $4.60 per gallon.

Some stations in Los Angeles were charging over $6.

In San Francisco, certain locations hit $7 per gallon.

The USC study predicting 8.43 per gallon by the end of 2026 no longer seemed outlandish.

Arizona watched its gas prices leap from 325 to 475 as refinery closures began.

Nevada went from 340 to 490.

Both states were now paying 50% more for gasoline.

The reason was simple.

California had driven out its refineries and Arizona and Nevada were paying the price.

Each month, the situation grew worse.

To make matters even more absurd, California began importing gasoline from Asia.

Tanker ships burning bunker fuel were crossing the Pacific Ocean to deliver gasoline to California.

The state that claims to lead the nation in fighting climate change was now importing fuel from South Korea.

Shipping gasoline across the Pacific Ocean produces far more emissions than refining it domestically.

California could claim lower instate emissions, but global emissions were actually increasing.

The environmental impact was worse, not better.

In September 2025, Philips 66 began its phase shutdown process.

The company gradually reduced production capacity in stages.

With each phase that went offline, pressure increased on remaining refineries.

As remaining capacity tightened, prices continued climbing.

Higher prices made other refineries reconsider their California operations.

The spiral was underway.

On October 10th, 2025, Fortune magazine published a headline that captured the situation perfectly.

California’s impossible dream of ending fossil fuels isn’t working.

Even mainstream business media could no longer ignore the unfolding disaster.

The article detailed how California had fundamentally miscalculated its ability to phase out liquid fuels while residents still drove gasoline powered vehicles.

Then came perhaps the most striking reversal of all.

On December 15, 2025, reports revealed that Governor Nuome was considering allowing expanded oil drilling to keep refineries supplied with crude.

This is the same governor who had pledged to ban new oil drilling by 2045.

Now, he was signing permits for expanded drilling operations, all while criticizing other states on social media for their energy policies, all while refusing to acknowledge his own policy reversals.

The California Energy Commission admitted officially that current gasoline refining capacity was insufficient to meet demand.

They noted that capacity drops even further during maintenance periods.

They acknowledged that imports cannot adequately replace lost local production.

Yet, they had implemented regulations that drove away 20% of that capacity.

By December 2025, gas prices were approaching $8 in parts of California.

Arizona and Nevada were consistently paying over $5 per gallon.

Refineries were fleeing.

Taxpayers might soon be funding bailouts for those that remain.

Tanker ships were importing gasoline from Asia.

New drilling permits were being issued.

Every single thing Arizona and Nevada warned about in their September 2024 letter had either happened or was in progress.

The predictions were not just accurate.

They were conservative.

Faced with this comprehensive policy failure, Governor Nuome still refuses to accept responsibility.

He continues to claim that refineries are gouging consumers.

He insists his regulations are saving money.

Anyone questioning his policies gets dismissed as protecting big oil.

Two governors, one Democrat and one Republican, issued a bipartisan warning.

They were dismissed as liars.

They were called corporate shills.

Now their states are paying $5 per gallon because California refused to listen.

The bipartisan nature of that warning made its dismissal even more remarkable.

This was not partisan politics.

This was not Republicans attacking a Democratic governor.

Katie Hobbs is a Democrat.

She was trying to protect her constituents from predictable consequences of California’s policies.

She was ignored and insulted for her efforts.

The economic impact extends beyond just gas prices.

Higher fuel costs affect everything.

Transportation costs rise.

Goods become more expensive.

Businesses face higher operating expenses.

Working families struggle to afford commuting to their jobs.

The ripple effects touch every corner of the economy.

For Arizona and Nevada, the injustice is particularly acute.

They have no control over California’s regulations.

They did not vote for these policies.

Yet they bear the consequences.

The infrastructure reality means they have no alternative.

They are completely dependent on California’s refinery system.

When California makes disastrous policy decisions, neighboring states simply have to accept the results.

California’s response has been to double down on failed policies while quietly undermining them through delays and bailouts.

The profit cap regulations got postponed.

Subsidies are being offered to keep refineries open.

New drilling permits are being approved.

All while publicly maintaining that the original policies were correct.

This is perhaps the most frustrating aspect of the entire situation.

Even as California scrambles to reverse course, officials refuse to admit the policies failed.

They refused to acknowledge that Arizona and Nevada were right.

They refused to learn from the disaster unfolding in real time.

Instead, they blame refineries for leaving a state that made operations economically impossible.

The national implications are also significant.

California is the largest state economy in the nation.

Its policy failures don’t remain confined to its borders.

When California experiences energy crisis, the effects spread.

other states watch and hopefully learn what not to do.

The question is whether policymakers are paying attention.

There is a broader lesson here about the relationship between policy intentions and policy outcomes.

California officials clearly intended to protect consumers and reduce emissions.

Those were the stated goals.

But good intentions do not guarantee good results.

The actual outcomes have been higher prices, increased imports, expanded drilling, and environmental damage from shipping fuel across the Pacific.

This is what happens when policymakers ignore basic economic realities.

You cannot simply regulate refineries into behaving how you want them to behave.

When you make operations unprofitable and regulatory compliance impossible, companies leave.

When companies leave, supply decreases.

When supply decreases, prices increase.

These are not complex economic principles.

They are fundamental market dynamics.

Arizona and Nevada understood this.

That’s why they sent their warning letter.

They understood that California’s policies would reduce supply and increase prices.

They understood their states would suffer the consequences.

They tried to prevent the disaster before it happened.

They were dismissed and insulted for their efforts.

Now we see the results.

Three states are experiencing significantly higher gas prices.

California’s refining capacity has dropped by 20% with more closures potentially coming.

Taxpayers may fund bailouts for remaining refineries.

The state is importing fuel from Asia while claiming to fight climate change.

This entire situation could have been avoided.

Arizona and Nevada provided fair warning eight months before the regulations were signed.

California’s own energy commission identified the risks.

Independent economists pointed out the obvious problems.

All of these warnings were ignored.

Governor Nuome proceeded with policies that have produced exactly the disaster everyone predicted.

And through it all, he has refused to take responsibility.

He continues pointing fingers at refineries.

He continues claiming his policies are working.

He continues dismissing critics as industry pawns.

Three states are paying the price for one governor’s refusal to admit error.

Gas prices are heading toward $8.

Refineries are closing and the person most responsible is too busy blaming everyone else to accept accountability.

That’s where we stand today.

Make sure you subscribe to Richard Lawson for more investigative reporting on the stories that matter.

Leave a comment below with your thoughts on this energy crisis and how it’s affecting your state.

Share this video with anyone who needs to understand what’s really happening with gas prices in the Southwest.

The question that remains unanswered is how much higher prices will go before California changes course and whether they’ll ever admit they were

News

Six Cousins Vanished in a West Texas Canyon in 1996 — 29 Years Later the FBI Found the Evidence

In the summer of 1996, six cousins ventured into the vast canyons of West Texas. They were last seen at…

Sisters Vanished on Family Picnic—11 Years Later, Treasure Hunter Finds Clues Near Ancient Oak

At the height of a gentle North Carolina summer the Morrison family’s annual getaway had unfolded just like the many…

Seven Kids Vanished from Texas Campfire in 2006 — What FBI Found Shocked Everyone

In the summer of 2006, a thunderstorm tore through a rural Texas campground. And when the storm cleared, seven children…

Family Vanished from Stillwater Lake Texas in 1995 — 27 Years Later FBI Found Box with Clothes

In the summer of 1995, the Whitlock family vanished without a trace during their weekend retreat at Stillwater Lake. Their…

Family Vanished from Stillwater Lake Texas in 1995 — 27 Years Later FBI Found Box with Clothes

In the summer of 1995, the Whitlock family vanished without a trace during their weekend retreat at Stillwater Lake. Their…

SOLVED: Arizona Cold Case | Robert Williams, 9 Months Old | Missing Boy Found Alive After 54 Years

54 years ago, a 9-month-old baby boy vanished from a quiet neighborhood in Arizona, disappearing without a trace, leaving his…

End of content

No more pages to load