I’m Elizabeth Davis and this is Elizabeth Davis.

Before we begin, I need you to do something critical right now.

Hit that subscribe button, click the notification bell.

This is the only official channel.

Many people are copying my content, my face, my style, but this is the original source.

Share this video with everyone you know in the Southwest because what I’m about to tell you affects millions of lives.

Comment below with your location and what you’re seeing at the pumps.

Now, let’s get into this.

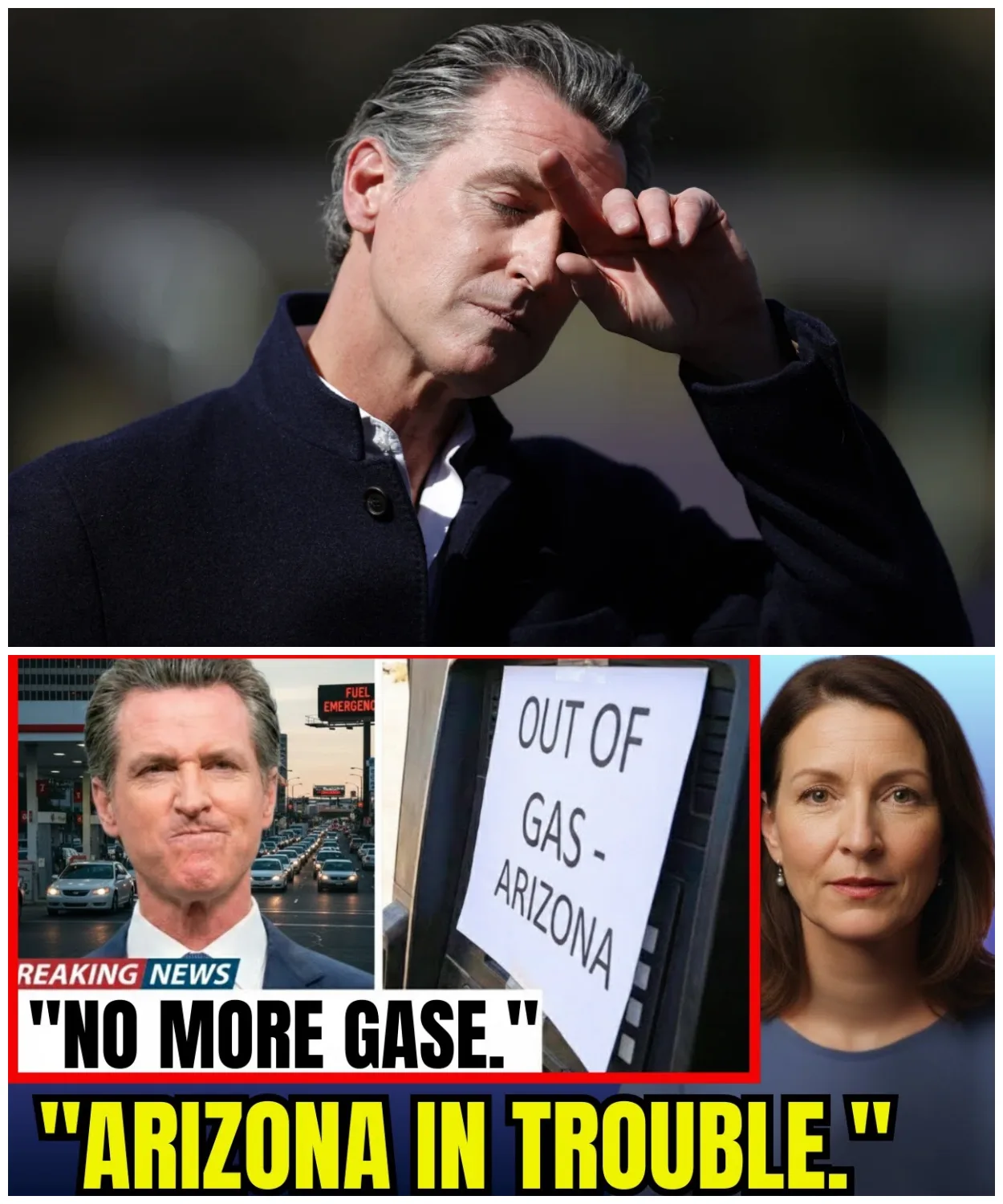

Arizona drivers woke up last week to something they absolutely did not expect.

Gas stations across Phoenix, Tucson, and Flagstaff started posting prices that looked more like California than the Southwest.

Some stations ran completely dry by midm morning.

Tanker trucks that usually arrive every two days were suddenly showing up half full or not at all.

This is not a local supply hiccup.

This is California’s refinery collapse spilling over state lines in real time.

What you are about to hear explains how a crisis 400 miles west just became Arizona’s problem, too.

And it is getting worse by the day.

California has lost nearly 20% of its refining capacity in less than 6 months.

Arizona, which relies heavily on California sourced fuel, is now facing shortages and price spikes that could redefine what people pay at the pump across the entire Southwest.

Here is what is actually happening on the ground right now.

Philips 66 shut down its Los Angeles refinery in December 2024.

That facility processed 139,000 barrels of crude oil every single day.

Valero announced its Benicia refinery will close by April 2026.

That is another 145,000 barrels per day gone.

Combined, these two closures wipe out 284,000 barrels of daily refining capacity.

That represents 21% of California’s total refining output.

These are not minor adjustments.

These are catastrophic losses to regional fuel infrastructure.

Then on December 15th, the San Pablo Bay pipeline shut down permanently.

That pipeline carried 100,000 barrels of crude oil daily from Kern County oil fields to Northern California refineries.

The company operating at Crimson Midstream was losing $2 million every single month.

They could not sustain those losses.

The pipeline stopped flowing.

California refineries lost their primary crude source overnight.

But the damage did not stop at California’s borders.

Here is the part most people do not understand.

Arizona does not produce gasoline.

The state has virtually no largescale refining capacity of its own.

Arizona relies on fuel supplied primarily from two sources.

California to the west and Texas to the east.

When California refineries were running at full capacity, they had surplus fuel to export to neighboring states.

Arizona gas stations, truck stops, airports, and commercial fleets depended on that surplus flowing east through pipeline networks and tanker trucks.

There is no surplus anymore.

California is now struggling to meet its own demand.

Every gallon California refineries produce stays in California.

The fuel that used to flow east into Arizona has been cut off.

Arizona is feeling the squeeze in real time.

Prices at Phoenix pumps jumped 40 cents per gallon in just 10 days.

Tucson stations are reporting delivery delays that stretch from 2 days to 5 days.

Flagstaff, which sits at higher elevation and requires special winter blend gasoline, is seeing shortages that force drivers to wait in lines.

The numbers tell the story clearly.

Arizona consumes roughly 2.3 million gallons of gasoline every single day.

California used to supply approximately 30% of that volume through direct pipeline connections and tanker deliveries.

That is nearly 700,000 gallons per day that Arizona stations could count on.

Now that flow has dropped by more than half.

Arizona is scrambling to find replacement sources from Texas and New Mexico.

But those supply chains were not designed to handle this sudden surge in demand.

There are five forces colliding right now that explain why this crisis jumped state lines so fast.

Let me break down each one because understanding the mechanics matters.

First, regulatory pressure in California made refining unprofitable.

In 2023, Governor Nuome signed SPX12, creating the Division of Petroleum Market Oversight.

The law authorized fines up to $1 million per day for suspected price manipulation.

Oil companies were suddenly operating under the threat of massive penalties for business decisions that regulators might interpret as gouging.

Then came ABX21 in 2024, which mandated strict minimum inventory levels for gasoline and diesel.

Companies were required to keep up to 16 days of fuel on hand at all times.

That sounds reasonable until you understand the economics.

Holding 16 days of inventory means building massive new storage tanks.

Each tank costs millions of dollars to construct.

The fuel sitting in those tanks represents capital that is tied up and not generating revenue.

Insurance costs for storing that much flammable material skyrocket.

Compliance monitoring requires additional staff and reporting systems for refineries already operating on thin margins.

These costs pushed operations into the red.

Philips 66 announced its Los Angeles closure just 2 days after ABX21 was signed.

That timing was not a coincidence.

Valero followed months later with the same message.

The regulatory environment became untenable.

They chose to shut down rather than absorb costs that guaranteed losses.

Second, California refineries are old and expensive to maintain.

Many facilities were built in the 1950s and60s during the post-war industrial boom.

Equipment that was cutting edge 70 years ago is now obsolete.

Boilers crack, pipelines corrode, control systems fail.

Upgrading aging infrastructure to meet modern environmental standards costs hundreds of millions of dollars per facility.

When profit margins are already thin and regulatory threats loom, those capital investments do not make financial sense.

Companies looked at the numbers and walked away.

The infrastructure that powered California for decades became economically obsolete overnight.

Here is a concrete example.

The Philips 66 Los Angeles refinery would have needed an estimated $400 million in upgrades over the next 5 years just to maintain current operations.

That does not include expansion or modernization.

That is just keeping the lights on.

When the company ran the numbers against projected revenue under the new regulatory framework, the math did not work.

Shutdown was the rational business decision.

600 full-time workers and 300 contractors lost their jobs.

But from a pure financial perspective, continuing operations would have cost the company even more.

Third, crude oil supply routes are collapsing.

The San Pablo Bay pipeline closure was the breaking point.

Northern California refineries depended on that pipeline to deliver Kern County crude for 70 years.

The pipeline ran 300 miles from Bakersfield oil fields all the way to Bay Area refineries.

When fully operational, it transported 100,000 barrels daily.

Without it, refineries have to source crude from imports or pay to truck it in.

Both alternatives cost far more.

Let me do the math on trucking.

Moving 100,000 barrels by truck requires roughly 625 tanker truck trips every single day.

Each truck holds about 160 barrels.

That is 625 trucks leaving Bakersfield and driving 300 miles to the Bay Area every 24 hours.

The fuel cost alone for those trucks is staggering.

Driver wages, truck maintenance, road wear, and accident risk all add up.

The economic and logistical reality is that trucking cannot replace pipeline capacity at scale.

Some refineries have no viable alternatives at all.

The supply chain that fed California refineries for seven decades just died, and there is no replacement infrastructure ready to take its place.

Fourth, California gasoline is unique gasoline.

The state requires a special cleaner burning blend to meet strict air quality standards established by the California Air Resources Board.

This is not just marketing.

The chemical formulation is genuinely different.

California gasoline has lower read vapor pressure, different oxygenate requirements, and stricter limits on sulfur and benzene content.

No other state uses the exact same specifications.

That means California cannot easily import gasoline from other regions when shortages hit.

Refineries in Texas or the Gulf Coast produce gasoline that meets federal standards, but not California’s requirements.

Importing compatible fuel requires finding specialty refineries or blending facilities that can match California specs.

Those are rare.

Most coastal refineries cannot economically justify maintaining separate California blend production lines for the limited export market.

California is functionally isolated from the national fuel supply.

When California’s own refineries shut down, there is no easy way to replace that lost production with imports.

Fifth, the ripple effect hits Arizona because the Southwest region is deeply interconnected.

Fuel does not respect state borders.

Pipelines, trucking routes, and distribution networks tie California, Arizona, Nevada, and New Mexico together into a single integrated system.

When California’s supply tightens, the entire region feels it immediately.

Arizona stations that relied on California surplus are now competing for shrinking supplies.

Fuel that used to be plentiful is suddenly scarce.

Prices respond instantly to supply and demand fundamentals.

Here is what that looks like on the ground.

A gas station owner in Tempe used to receive fuel deliveries every Monday and Thursday like clockwork.

Last week, Monday’s delivery was cut by 40%.

Thursday’s truck did not show up at all.

The distributor explained that California refineries are prioritizing in-state customers.

Arizona is getting what is left over.

That station owner raised prices by 35 cents per gallon just to slow demand and avoid running completely dry before the next delivery arrives.

Multiply that story across hundreds of stations and you see how quickly regional supply chains break down.

Now, let me give you three scenarios based on what could happen over the next 6 to 12 months.

These are not predictions.

These are possibilities grounded in the data we have right now.

Best case scenario, California manages to stabilize its remaining refining capacity through emergency regulatory relief and industry cooperation.

The Valero Benicia closure is delayed or canled after state officials negotiate a temporary exemption from some inventory requirements.

Emergency measures kick in to increase imports from compatible refineries on the West Coast.

Washington and Oregon refineries ramp up California spec production and increase exports south.

Meanwhile, Arizona negotiates direct supply agreements with Texas refineries and expands pipeline capacity from the Gulf Coast.

New contracts are signed.

Infrastructure is prioritized.

Fuel shipments arrive consistently.

In this scenario, prices spike temporarily but stabilize within 3 to four months.

Arizona sees prices rise 10 to 15% above historical averages but avoid sustained shortages.

Some rural stations still face intermittent supply issues, but urban areas maintain steady availability.

Commercial trucking companies absorb higher costs, but continue operations.

Tourism does not collapse.

Life continues with some financial pain, but no major disruptions to daily routines or economic activity.

This scenario requires several things to go right simultaneously.

California regulators must show flexibility.

Oil companies must invest in workarounds.

Texas refineries must have spare capacity to redirect to Arizona.

All of these elements need to align within a narrow time window.

Base case scenario, California’s refinery closures proceed exactly as planned.

Arizona faces intermittent shortages, especially during peak summer driving season.

Some rural gas stations run dry for days at a time during holiday weekends.

Arizona sees sustained price increases of 25 to 35% compared to 2024 averages.

Diesel prices spike even higher.

Trucking companies face serious margin compression.

Delivery times stretch longer.

Grocery prices tick up.

This becomes the new normal.

Worst case scenario, another California refinery shuts down unexpectedly.

Import capacity cannot scale fast enough.

Arizona fuel supply drops below critical thresholds.

Governors declare energy emergencies.

Fuel rationing gets implemented.

Prices surge 40 to 60% or higher.

Gas lines form.

Businesses curtail operations.

Tourism collapses.

The Arizona economy contracts sharply.

Here is what you need to remember.

California just lost 284,000 barrels per day of refining capacity.

The San Pablo Bay pipeline shut down permanently.

Arizona relies on California surplus that no longer exists.

The next 6 months will determine whether this becomes manageable or a full-blown crisis.

So, here is my question for you.

Do you think Arizona can secure alternative fuel sources fast enough or are we watching the beginning of a long-term energy crisis that fundamentally changes how we live? Have you noticed price increases at your local stations? What are you doing to prepare? Drop your thoughts in the comments below.

If you found this breakdown valuable, subscribe to Elizabeth Davis right now.

Share this video with anyone in Arizona, Nevada, New Mexico, or Southern California.

This crisis is just beginning.

The decisions made in the next few months will affect millions of people for years to come.

This is a regional emergency unfolding in slow motion.

Stay informed, stay prepared, and keep watching.

News

Six Cousins Vanished in a West Texas Canyon in 1996 — 29 Years Later the FBI Found the Evidence

In the summer of 1996, six cousins ventured into the vast canyons of West Texas. They were last seen at…

Sisters Vanished on Family Picnic—11 Years Later, Treasure Hunter Finds Clues Near Ancient Oak

At the height of a gentle North Carolina summer the Morrison family’s annual getaway had unfolded just like the many…

Seven Kids Vanished from Texas Campfire in 2006 — What FBI Found Shocked Everyone

In the summer of 2006, a thunderstorm tore through a rural Texas campground. And when the storm cleared, seven children…

Family Vanished from Stillwater Lake Texas in 1995 — 27 Years Later FBI Found Box with Clothes

In the summer of 1995, the Whitlock family vanished without a trace during their weekend retreat at Stillwater Lake. Their…

Family Vanished from Stillwater Lake Texas in 1995 — 27 Years Later FBI Found Box with Clothes

In the summer of 1995, the Whitlock family vanished without a trace during their weekend retreat at Stillwater Lake. Their…

SOLVED: Arizona Cold Case | Robert Williams, 9 Months Old | Missing Boy Found Alive After 54 Years

54 years ago, a 9-month-old baby boy vanished from a quiet neighborhood in Arizona, disappearing without a trace, leaving his…

End of content

No more pages to load