Welcome to Richard Lawson.

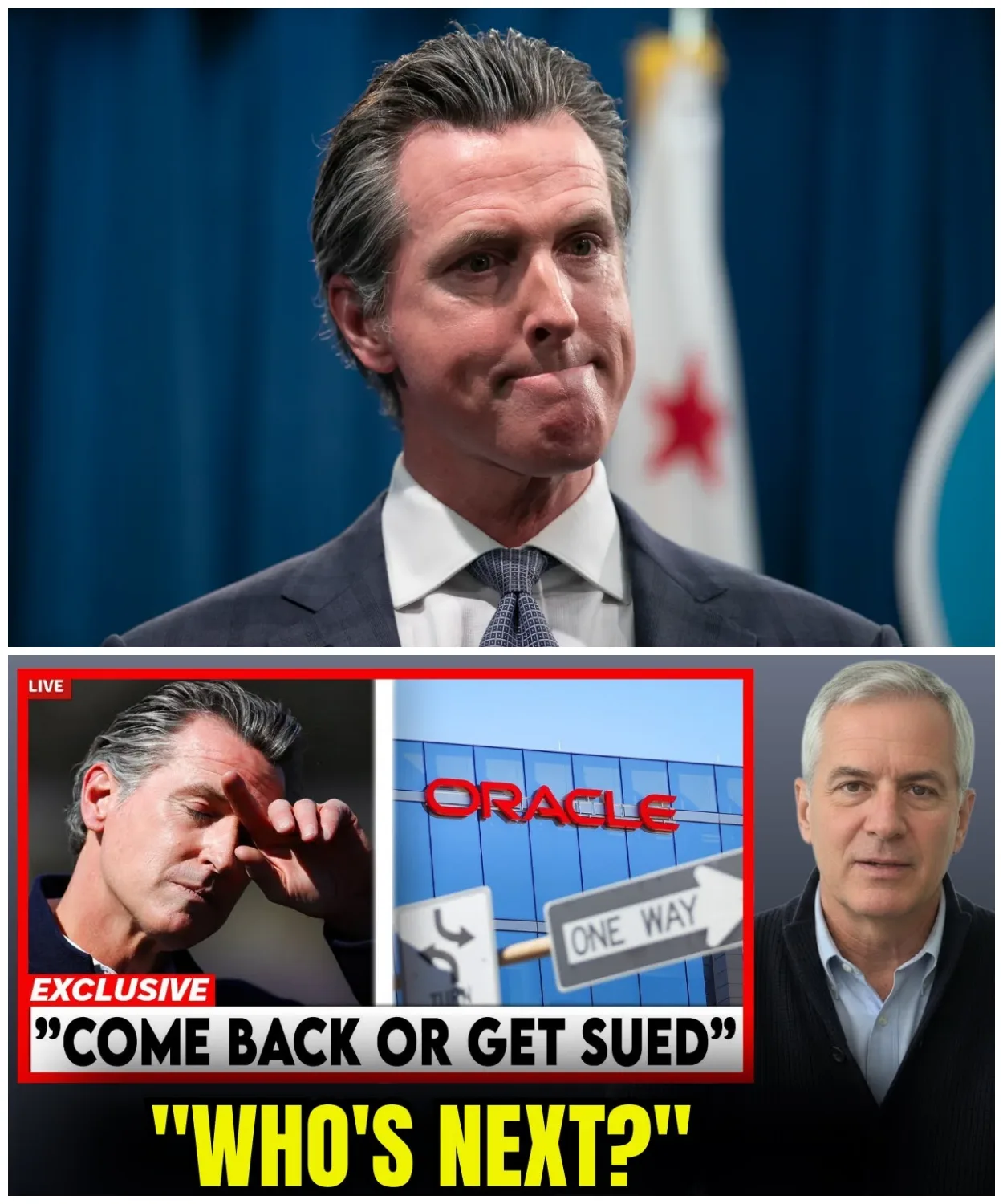

I’m Richard Lawson and today we’re investigating one of the most consequential corporate retreats in modern American history.

Before we dive in, make sure to hit that subscribe button, leave a comment with your thoughts, and share this video with anyone who needs to understand what’s really happening to California’s economy.

On Friday, December 11th, 2020, as Wall Street closed for the weekend, Oracle Corporation quietly filed a single sentence with federal regulators that would send shock waves through Silicon Valley after 43 years anchored in California.

Their $200 billion headquarters was gone, relocated to Texas.

No press conference, no explanation, no farewell.

Within months, the billionaire founder had vanished to his private Hawaiian island, and Oracle was not finished moving.

Was this a calculated business escape or the first domino in California’s corporate unraveling? The truth behind Oracle’s silent exit reveals far more than anyone expected.

This is the story of how one of America’s most powerful tech giants slipped out the back door of California and what it means for the future of American business.

Oracle’s headquarters had sat on the edge of the Redwood Shores Lagoon for over three decades.

A glass and steel monument to Silicon Valley’s rise, a symbol of technological dominance.

On December 11th, 2020, the company’s legal team submitted a single sentence to the Securities and Exchange Commission.

Oracle is implementing a more flexible employee work location policy and has changed its corporate headquarters from Redwood City, California to Austin, Texas.

That was it.

No press release, no investor call, no statement from the CEO.

The announcement was buried in a routine regulatory filing timed perfectly for after the markets closed on a Friday afternoon.

A deliberate move designed to avoid headlines and difficult questions.

For a company valued at $200 billion, this was not how most analysts expected such a seismic decision to be revealed.

The silence was deafening.

Oracle’s departure was not marked by speeches or celebrations.

It was a quiet extraction, as if the company was slipping away from California without saying goodbye.

The filing cited flexibility and remote work, echoing a post-pandemic trend sweeping corporate America, but it offered no details about what actually prompted the move.

There was no mention of taxes, no discussion of regulations or rising costs, just a carefully worded sentence designed to meet federal disclosure rules.

while drawing as little attention as possible.

As investors and employees scrambled to interpret the news, another surprise surfaced.

Larry Ellison, the company’s co-founder and public face, did not follow Oracle to Austin.

Instead, he relocated to Lai, a remote Hawaiian island where he personally owns 98% of the land.

While Oracle’s official corporate address shifted to Texas, Ellison’s new home was 2,400 miles from the Bay Area and even farther from the new headquarters he had just established.

The billionaire who built his empire in California chose to run his company from a private paradise, not from the city that had just become Oracle’s official base.

This divergence between corporate paperwork and executive action raised more questions than it answered.

Oracle’s silent move and Ellison’s retreat to Lanai were not just about changing zip codes.

They signaled a new era of corporate agility where headquarters could be relocated with a single sentence filed after hours on a Friday.

Where a founder could direct global operations from anywhere on Earth.

For California, the loss was more than symbolic.

Oracle’s quiet escape made one thing crystal clear.

Even the giants of Silicon Valley could disappear overnight, leaving behind only a line in an SEC filing and an empty executive suite.

But Oracle was not done moving.

On April 23rd, 2024, the headquarters story took another sharp turn.

Larry Ellison speaking at a health care summit casually revealed that the company was moving its official home base again, this time to Nashville, Tennessee.

The decision was not about chasing lower taxes or warmer weather.

It was about health care.

Oracle had closed a 28 billion acquisition of Cerner, one of the largest health IT companies in the country.

Suddenly, the company’s future was tied directly to the heart of America’s health care industry.

Nashville is not just a city with a few hospitals.

It is a health care powerhouse, home to 18 publicly traded health care companies and nearly 100 billion dollars in annual health care revenue.

For Oracle, the move meant direct access to industry leaders, specialized talent, and a vast customer base.

The company committed to building a $1,2 billion campus on 60 acres of riverfront land aiming to create a new epicenter for healthcare technology.

The architectural design would come from the same firm behind Apple Park, promising a modern, sprawling headquarters built for scale and innovation.

Tennessee’s government did not sit on the sidelines.

State and local officials approved $65 million in performance-based grants, tying every single dollar to job creation and investment milestones.

Oracle signed a binding agreement, $8,500 new jobs, each position paying an average of $110,000 per year.

The first phase of construction was set to open by 2026.

Annual payroll from the new campus was projected to reach $935 million, injecting serious economic momentum into the region.

The grants came with strict clawback provisions.

If Oracle failed to deliver on its commitments, the money would have to be repaid.

Oracle’s healthcare division would anchor the new Nashville campus, drawing on Cerner’s deep roots in medical software and data systems.

Unlike the quiet Texas move, the Nashville plan was public, ambitious, and deeply strategic.

Oracle was not just moving for a better tax deal.

It was repositioning itself at the geographic center of a booming industry, betting that proximity to health care giants and a specialized workforce would pay dividends for years to come.

With this move, Oracle demonstrated how corporate headquarters have evolved.

They are no longer just real estate.

They are strategic tools for business alignment, able to leap from stateto state in pursuit of new markets and government incentives.

Tennessee, once an afterthought in the technology world, suddenly found itself competing for the future of enterprise software and healthcare innovation.

Oracle had turned the headquarters concept into a weapon of competitive advantage.

Oracle’s retreat from California was not just a line in a regulatory filing.

It triggered a wave of real consequences for the commercial real estate market and the workforce left behind.

As soon as the headquarters address officially changed, the company began offloading Bay Area properties.

Large blocks of San Francisco office space went up for sub lease.

Oracle listed more than 50 acres of its Santa Clara campus for sale, a parcel that once symbolized the company’s deep roots in Silicon Valley.

The Redwood Shores campus, however, remained untouched, a sign that the company was not cutting all ties to California.

But the broader impact hit the San Francisco commercial real estate market like a shockwave.

In 2019, office vacancies hovered around 47%.

By 2024, that number had surged to 37%.

An eight-fold increase that left over 29 million square feet sitting empty.

Towers that once commanded premium prices saw their values collapse almost overnight.

The 17story building at 995 Market Street plummeted from $62 million in 2016 to just $65 million in 2023.

A stunning 90% drop in value.

Bidding for 350 California Street tumbled from $300 million down to around $60 million.

Even major hotels were not immune.

The combined value of the Union Square Hilton and Park 55 fell by more than $1 billion.

Yet behind the headlines, Oracle’s workforce told a different story.

Despite the official Texas address, the company still employed nearly 6,900 people in California, almost three times as many as in Texas.

The headquarters may have moved on paper, but the bulk of the company’s operations, talent pool, and day-to-day business remained firmly planted in the Bay Area.

For market analysts watching closely, Oracle’s decisions became both a symbol and an accelerant of San Francisco’s commercial real estate turmoil.

The question was no longer if other companies would follow Oracle’s lead.

The question was how many and how fast.

California’s fiscal reality now reads like a cautionary tale for business strategists and policy makers alike.

In just three years, 352 companies moved their headquarters out of the state.

According to Hoover Institution Tracking, IRS migration data reveals that 102 billion in adjusted gross income left California between 2020 20 and 2022.

much of it flowing from high earners and business owners seeking better opportunities elsewhere.

The exodus included $24,670 taxpayers making over $200,000 in the most recent reporting year alone, draining $161 billion in taxable income directly from the state’s ledgers.

This outflow hit California’s budget with rare and brutal force.

In May 2022, California reported a record 975 billion surplus booied by stock market gains and technology sector windfalls.

By December 2023, that surplus had flipped entirely to a 68 billion deficit.

The swing totaled 165 billion in just a year and a half, a reversal that caught even veteran financial analysts offguard.

State Treasury officials pointed to the extreme volatility of personal income taxes, which rely heavily on the financial fortunes of the top 1%.

When markets falter or high earners relocate, tax revenue collapses.

Income tax collections drop 27% in a single year, forcing 34 billion in emergency spending cuts and draining state reserves by half.

Yet, despite these alarming trends, California’s economic engine refuses to stall completely.

The state still claims 58 Fortune 500 headquarters, more than any rival state in the nation.

Venture capital investment remains unmatched.

In 2024, California captured nearly 49% of all US venture capital dollars, totaling 81 billion in deployed capital.

Venture analysts credit the state’s talent density, innovation clusters, and unparalleled global reach.

For every company that leaves, dozens more are funded, built, or expanded within the state’s technology corridors.

The state’s universities continue to produce top tier engineering talent.

Its research institutions drive cutting edge innovation.

Its cultural magnetism still attracts ambitious entrepreneurs from around the world.

But the risk is undeniably real.

And so is the opportunity.

California’s future will be decided on this razor’s edge, a battle between the forces driving businesses away and the deep structural advantages that keep new ventures flowing in.

The question is whether the state can adapt fast enough to reverse the tide.

Corporate headquarters may shift zip codes with the stroke of a pen, but talent and capital chase opportunity wherever it emerges.

As California’s fiscal and regulatory challenges continue to mount, its economic future hangs on a single question.

Will it adapt or will it watch more corporate giants quietly slip away? The next move is not just oracles to make.

It is California’s.

The state faces a critical decision point.

It can double down on the policies that have driven companies out or it can recalibrate and compete aggressively for the next generation of business investment.

Other states are not waiting.

Texas, Tennessee, Florida, and Nevada are rolling out competitive incentives, streamlined permitting, and businessfriendly regulatory environments designed specifically to lure California companies across state lines.

The competition for corporate headquarters has become a full contact sport, and California is no longer the undisputed champion.

What happens next will not just determine the fate of California.

It will reshape the entire American business landscape for decades to come.

The Oracle story is not an isolated incident.

It is a warning signal, a preview of what could become a mass migration if the underlying issues are not addressed.

The stakes could not be higher.

California built the modern technology economy.

It pioneered venture capital.

It created the model for innovationdriven growth that the rest of the world has tried to replicate.

But legacy and reputation can only carry a state so far when the fiscal math stops working and companies can relocate with a single filing.

Make sure to subscribe to Richard Lawson for more in-depth analysis on the forces reshaping the global economy.

Drop a comment below and let me know your thoughts.

Do you think California can turn this around? Or are we witnessing the beginning of a long-term decline? Share this video with anyone who needs to understand what is really happening behind the headlines.

Oracle’s silent exodus is over.

But the consequences are only beginning to unfold.

The question now is who leaves next and whether California will finally wake up before it is too late.

This is Richard Lawson.

Stay informed, stay critical, and keep watching.

News

Six Cousins Vanished in a West Texas Canyon in 1996 — 29 Years Later the FBI Found the Evidence

In the summer of 1996, six cousins ventured into the vast canyons of West Texas. They were last seen at…

Sisters Vanished on Family Picnic—11 Years Later, Treasure Hunter Finds Clues Near Ancient Oak

At the height of a gentle North Carolina summer the Morrison family’s annual getaway had unfolded just like the many…

Seven Kids Vanished from Texas Campfire in 2006 — What FBI Found Shocked Everyone

In the summer of 2006, a thunderstorm tore through a rural Texas campground. And when the storm cleared, seven children…

Family Vanished from Stillwater Lake Texas in 1995 — 27 Years Later FBI Found Box with Clothes

In the summer of 1995, the Whitlock family vanished without a trace during their weekend retreat at Stillwater Lake. Their…

Family Vanished from Stillwater Lake Texas in 1995 — 27 Years Later FBI Found Box with Clothes

In the summer of 1995, the Whitlock family vanished without a trace during their weekend retreat at Stillwater Lake. Their…

SOLVED: Arizona Cold Case | Robert Williams, 9 Months Old | Missing Boy Found Alive After 54 Years

54 years ago, a 9-month-old baby boy vanished from a quiet neighborhood in Arizona, disappearing without a trace, leaving his…

End of content

No more pages to load